Trading in Complex Networks

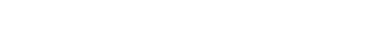

Global supply networks in agriculture, manufacturing, and services are a defining feature of the modern world. The efficiency and the distribution of surpluses across different parts of these networks depend on the choices of intermediaries. This paper conducts price formation experiments with human subjects located in large complex networks to develop a better understanding of the principles governing behavior. Our first finding is that prices are larger and that trade is significantly less efficient in small-world networks as compared to random networks.

Our second finding is that location within a network is not an important determinant of pricing. An examination of the price dynamics suggests that traders on cheapest — and hence active — paths raise prices while those off these paths lower them. We construct an agent-based model (ABM) that embodies this rule of thumb. Simulations of this ABM yield macroscopic patterns consistent with the experimental findings. Finally, we extrapolate the ABM on to significantly larger random and small-world networks and find that network topology remains a key determinant of pricing and efficiency.

F. M. Cardoso, C. Gracia-Lázaro, F. Moisan, S. Goyal, A. Sánchez, and Y. Moreno, “Trading in Complex Networks”. Submitted for publication, preperint available at the link below.